ACH (ADRIA MOBIL, UNION HOTELS, AUTOCOMMERCE...) - independent expert reports show the company was worth at least € 259.4 million more (add. 118%) at squeeze-out than shown & earmarked for expropriated shareholders by main shareholder (& key stakeholders)

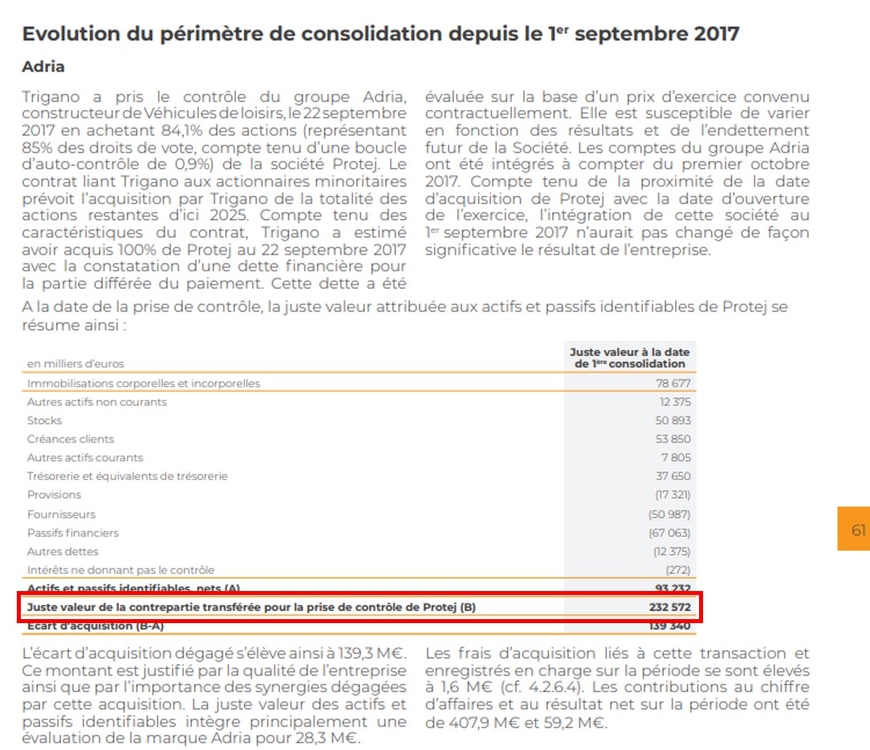

Today, the VZMD published "A detailed presentation of the development of proceedings and negotiations with the main shareholder as well as the technical basis regarding the adequacy of the monetary compensation in the process of exclusion of minority shareholders of ACH d.d." The document is a summarized overview of extensive documentation (over 400 pages) and shows that the adequate remuneration should amount to at least EUR 180.70 per share, which is by 117.70% higher than the offered remuneration to the 251 minority shareholders, which was meager EUR 83.00. The VZMD proved these statements with independent expert analyses, which glaringly show that the appraisal of key ACH d.d. investments – investment of 99.72% of ADRIA MOBIL d.o.o. capital, 75.32% of UNION HOTELS d.d. capital and 100% of AVTO TRIGLAV d.o.o. capital – has not even remotely taken into account the actual economic and financial situation of these companies on the squeeze-out date.