Today, the VZMD published "A detailed presentation of the development of proceedings and negotiations with the main shareholder as well as the technical basis regarding the adequacy of the monetary compensation in the process of exclusion of minority shareholders of ACH d.d." The document is a summarized overview of extensive documentation (over 400 pages) and shows that the adequate remuneration should amount to at least EUR 180.70 per share, which is by 117.70% higher than the offered remuneration to the 251 minority shareholders, which was meager EUR 83.00. The VZMD proved these statements with independent expert analyses, which glaringly show that the appraisal of key ACH d.d. investments – investment of 99.72% of ADRIA MOBIL d.o.o. capital, 75.32% of UNION HOTELS d.d. capital and 100% of AVTO TRIGLAV d.o.o. capital – has not even remotely taken into account the actual economic and financial situation of these companies on the squeeze-out date.

Extensive expert analyses show, among other things, that the difference in the appraisal value of they key ACH Group companies (Adria Mobil, Union Hoteli and Avto Triglav) – between the value advocated by the main shareholder Protej d.o.o. and the informed independent appraisal value – totals at EUR 259.4 million or at least additional EUR 97.70 per share!

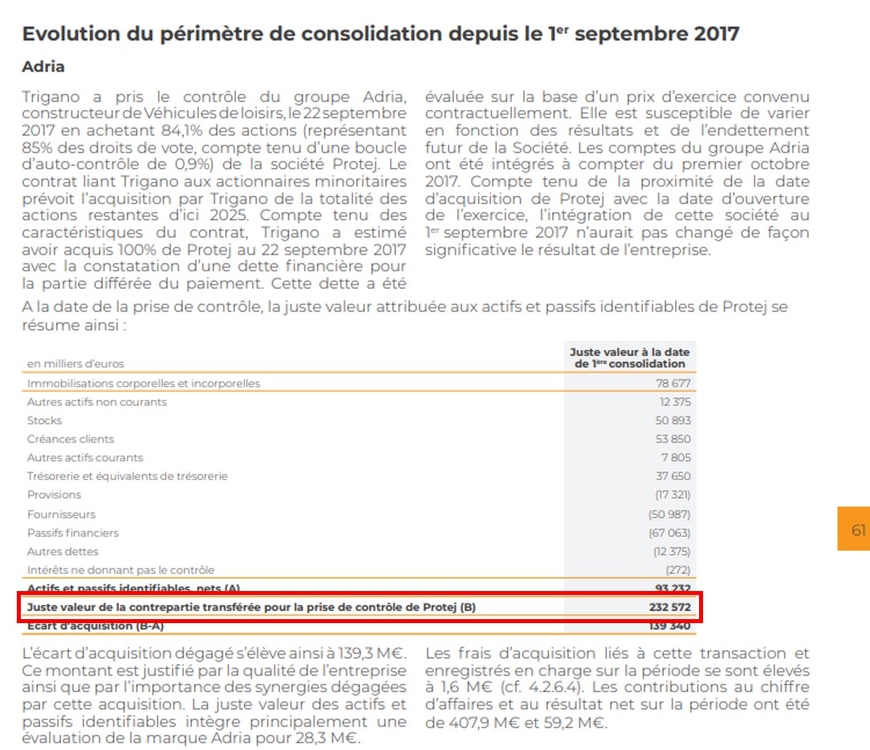

The main shareholder arguments the remuneration amount in the context of the PROTEJ d.o.o. takeover by the French company TRIGANO, and claims that the remuneration is adequate and corresponds to the price Trigano paid for the majority share in Protej. As regards the progress of the entire transaction, the main shareholder has not given clear and unequivocal information, and did not want to explain the circumstances and the progress of the transaction. The main shareholder only stated that, in his opinion, the transaction was a pure market transaction between two independent parties, and that the takeover price was EUR 180 million. However, the VZMD points out that in the 2018 annual report (p. 61) Trigano states that the fair transactional value was EUR 232.5 million. The main shareholder and its representatives have not yet explained this discrepancy!

The VZMD decided to publish the findings of independent third party experts, because in the numerous meetings – which took place between the representatives, agents and owners of the main shareholder (Protej d.o.o.) and the VZMD representatives since the 2017 squeeze-out – the main shareholder has acted in a non-transparent and even misleading manner This is also why VZMD requested that the Court question the witnesses at the first hearing in February of 2018. The witnesses came from the former management of the main shareholder and ACH: Mr. RASTO ODERLAP, the former ACH general manager, Mr. PETER KRIVIC, the ACH CFO, Mr. PRIMOŽ RAKTELJ, the former Protej general manager, and MATEJ RIGELNIK.

Namely, the VZMD associates and attorneys have witnessed the various legal maneuvers, use of clever tactics and constant procrastination at the squeeze-out itself, when Protej even agreed to an out-of-court inspection of the adequacy of the remuneration, but Protej has also kept using the same actions before the Mediation Committee appointed by the Court. In the numerous meetings before the Mediation Committee, during the last half of year, it has unfortunately become an established practice that, at the last minute, the VZMD receives inadequate answers lacking any meaning from the main shareholder.

So, for instance, the main shareholder has not even delivered the valuation report which served as a basis for determining monetary compensation for minority shareholders, which is basically a standard in such transactions. The VZMD associates were only granted access to the (comprehensive) valuation report at the General meeting itself and twice again later for a very limited period of time, whereby they were not permitted to copy parts of the valuation report. Supplying the basic documents (valuation reports, company operations data during the squeeze-out), which serve as a basis for determining the monetary compensation by the main shareholder, is not only a basic business standard but also a legal requirement, which is, in this event, grossly violated by the main shareholder Protej d.o.o. This is why the VZMD called on the main shareholder, verbally and in writing, to deliver the basic documents on several occasions, both directly and via – court-appointed – representatives of the Mediation Committee. However, they have not yet managed to obtain the full valuation reports, except for some limited and even misleading data and statements. Furthermore, the VZMD points out that the main shareholder acts extremely non-transparently, which has aroused doubts as to the adequacy of valuation assessments, and thus the adequacy of the monetary compensation amount for the minority shareholders.

Based on the expert analyses, the VZMD has inferred that it is glaringly obvious that the acquisition of Protej d.o.o. by the acquirer Trigano is merely a technical step in the acquisition intent to gain 85% of the effective ownership of Adria Mobil, whereas the main shareholders of Protej (through which they were the main shareholder of ACH d.d.) retained the ownership of the remaining assets in the ACH Group. As part of the acquisition transaction and following the draft terms of division of ACH d.d., the main shareholders of Protej namely became owners of spun-off companies ACH (ADRIA MOBIL, subsequently renamed to AMH), ACH 2 (automotive pillar – AUTOCOMMERCE, AVTO TRIGLAV, AC MOBIL) and ACH 3 (the hotel pillar – UNION HOTELS, subsequently renamed to AXOR HOLDING). After selling their shares in Protej, the largest shareholders of Protej (actually also the largest shareholders of ACH), retained the ownership of the ACH assets pursuant to the draft terms of division, which means that they were not actually selling their equity interest in the first place. They did officially sell their shares in Protej, but they subsequently bought back the spun-off companies pursuant to the draft terms of division and the mutual shareholder agreement.

For instance, Ms. SONJA GOLE (the CEO of ADRIA MOBIL), along with several other shareholders, retained her ownership in Protej d.o.o. (15% in total) and is now an indirect owner of the ADRIA MOBIL group, partners Mr. RASTO ODRLAP, Mr. DAMIJAN VUK and Mr. JANKO ŠEMROV are the owners of ACH 2 (the automotive pillar), whereas the ownership structure of ACH 3, subsequently renamed to AXOR HOLDING is not been publicly known, because the ownership of the company is assigned to a bearer (there are public speculations that the majority ownership of Axor holding is in the hands of the RIGELNIK family or persons associated with the family). In the meetings held so far, the representatives of the main shareholder highlighted that amongst shareholders of Protej there were multiple groups (fractions) of shareholders with different interests, that in the years before Protej had been sold to Trigano, they had internal conflicts and disputes over selling of specific assets, and that selling Protej and the ACH's draft terms of division was a compromise to end the conflicts between Protej shareholders. Under such circumstances, the motive of largest shareholders was not price optimization, but more likely the rules of draft terms of division regarding the assets, and thus the relative ratios between shareholders.

www.vzmd.si – More on the VZMD – PanSlovenian Shareholders' Association

www.vzmd.tv and www.investo.tv – Over 300 videos from VZMD.TV and investo.tv

www.investo.si – More on the investo.si – Invest to Slovenia Program

www.invest-to.net – More on the network of 65 national organizations of shareholders and investors – investo.international