Last Tuesday, the 19th Annual European Financial Services Conference (EUFSConf21) took place; it is considered one of the major events in Brussels that usually attracts over 400 international participants, particularly representatives of banks and the financial industry, decision-makers and policy-makers who discuss each year’s most important issues affecting the European and global financial markets.

The Conference hosted by BARCLYS, GENERALI in KREAB took place as a virtual event, and more than 20 speakers shared their views and opinions, including Chairman of Generali Group, Gabriele Galateri di Genola, Chief Executive Officer at Barclays Europe, Francesco Ceccato, and Chief Executive Officer at London Stock Exchange Group, David Schwimmer, while the honorary speaker was the Minister of Finance of the Republic of Slovenia Mr. Andrej Šircelj. At the invitation of the organizers, the event was also attended by the VZMD President Mr. Kristjan Verbič, who actively participated and – similarly as at the recent Convention of the Federation of European Securities Exchanges – posed a number of questions to the minister Šircelj and other attendees.

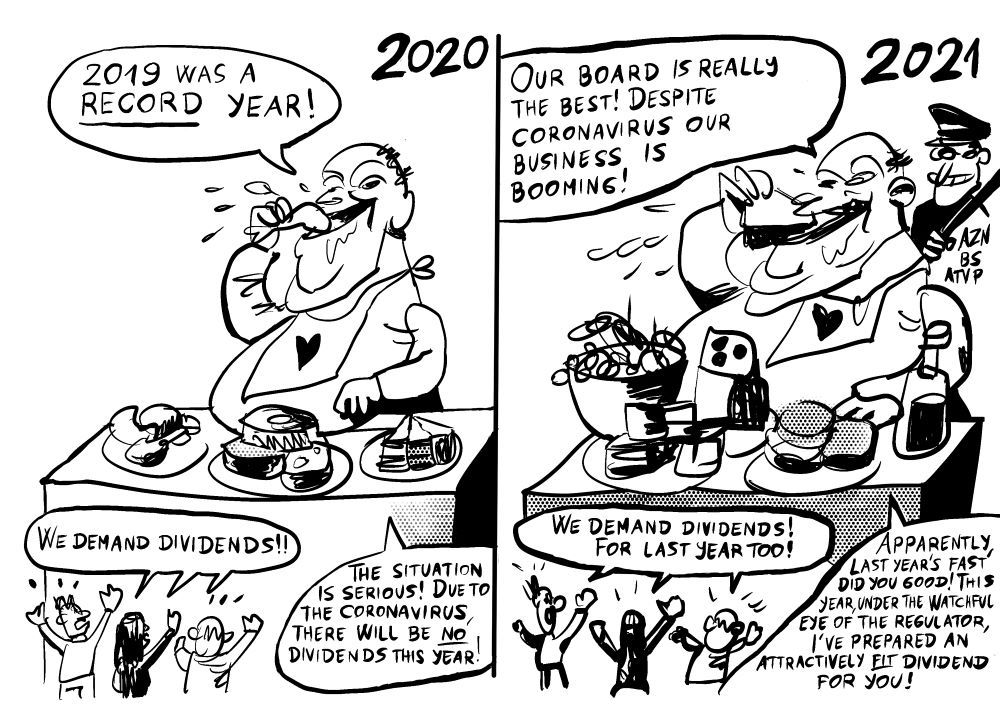

Among other things, Mr. Verbič asked what kind of agenda has Slovenia prepared for its Presidency with respect to achieving the ambition of a joint European capital market, and why is Slovenia constantly (VIDEO) additionally restricting and limiting fiduciary accounts for securities (VIDEO) – which are of vital importance for cross-border (and European) securities trading – pointing out how this is in direct violation of the EU acquis, which is why VZMD had to initiate the proceedings at the European Commission. The aforementioned also makes it more difficult to carry out the program called “Share SUPPORT”, which was established by VZMD to make the shareholding and access to the securities market easier for minority shareholders and individual investors, which is one of EU’s priorities. The European Federation of Investors and Financial Services Users also spoke up in favor of a smooth functioning, protection and strengthening of the “Share SUPPORT” (BETTER FINANCE).

At four sessions, the participants discussed the opportunities and challenges of re-establishing business operations in a post-pandemic era that brought many new solutions and improvements. Other topics included the increasingly popular sustainable and long-term investing, central bank digital currencies – the future of the digital euro, and Europe and the emerging new global partnerships that will mark the future. These are certainly topical issues that VZMD wants to address, at least to some degree, at the upcoming international investor conference in September in Slovenia, organized once more by VZMD together with BETTER FINANCE (VIDEO). Considering that the meeting will be attended by the World Federation of Investors (WFI) as well as many other international participants who will visit Slovenia during its presidency of the Council of the EU, VZMD expects an excellent discussion – also because many different stakeholders from this field will finally be able to meet in person.

As a longstanding member of EUROSHAREHOLDERS, BETTER FINANCE and WFI, VZMD has demonstrated its excellent organization of such high meetings and events in the past. Among other events, they organized international annual meetings in Ljubljana already in 2008 (VIDEO) and again in 2012 (VIDEO), where – as part of the wider event Investors` Week – close to 170 representatives and members of three of the largest world associations of individual investors met and adopted THE LJUBLJANA DECLARATION (VIDEO). Additionally, VZMD has been performing other activities for the members of its business-investment programs: investo.si and investo.international; in the past 8 years they carried out more than 60 international tours (VIDEO), where they ensured active participation and presentations at more than 150 international business conferences and investor meetings, on 5 continents. This event will be again covered by the team of VZMD.tv, which has gathered a lot of experience in the past years with picturesque reports on events abroad (VIDEO).

VZMD and BETTER FINANCE would like to extend the invitation to anyone interested to participate and enrich the program and are striving to carry out these events with direct participation if there is a good epidemiological forecast. Should this not be possible, the meetings will be virtual. More information on the events and participation opportunities will be given by VZMD in the coming weeks.