After the Registry court entered the decision to squeeze out the Mercator minority shareholders into the court register (VIDEO: undefined), VZMD has already filed a motion to stay the proceedings, as well as the appeal at the District Court in Ljubljana. Namely, VZMD is challenging the decision – reached by the majority shareholder FORTENOVA GRUPA, d.d. (90.005%) for itself – at the Court; consequently, the decision could not be entered into the court register until the Court of First Instance reached a decision regarding the so-called breaking of the registry lock. Upon Mercator's proposal, the Court of First Instance weighed on whether the entry applicant would incur damages due to the registry lock, the significance of the lodged appeals on the rights of the minority shareholders, and the probability of a successful outcome of the plaintiffs' legal actions. "In her decision, the judge Melita Štefančič completely ignored the Council Regulation (EU) 2022/428 of 15 March 2022, which prohibits direct and indirect participation in any transaction for the benefit of the companies under direct or indirect control of the Russian state which is, in this case, incontrovertible," pointed out the VZMD President, Mr. Kristjan Verbič.

VZMD reiterates that the point of the legal actions is the fact that the conditions for the squeeze-out were not met because the majority shareholder, Fortenova grupa, did not exceed the required 90% threshold of the voting shares. Fortenova grupa would exceed this threshold – with surgical precision of 0.005%(!) – only when taking into account the extremely controversial recapitalization in October 2021, which VZMD is also challenging in court. The controversial recapitalization which included only the majority shareholder while the minority shareholders were excluded, was completely unnecessary for Mercator from the economic point of view. Fortenova's in-kind contributions increased Mercator's nominal capital from EUR 218.2 million by a mere EUR 5.9 million to EUR 224.1 million! "When VZMD shall prove in court that such recapitalization was completely unnecessary from the business point of view, as well as discriminatory to other shareholders and therefore illegal, Fortenova grupa will no longer meet the conditions for squeezing out the minority shareholders. How will the shares be returned to the minority shareholders in this case? This is an extremely dangerous precedence which the majority shareholders could also begin to take advantage of in other cases where they are unable to squeeze out the minority shareholders with too-low takeover bids," warns Mr. Verbič.

When deciding on the breaking of the registry lock, the Court entirely uncritically followed Mercator's claims, especially when deciding on what kind of damages the applicant and majority shareholder would incur in case of the registry lock, and especially when it decided on the probability of an successful outcome of the plaintiffs' legal actions. At the same time, it completely ignored the interests of the minority shareholders who filed the above-mentioned legal actions to protect their own interests. This is why the Court of First Instance ruled that the damages to Mercator and Fortenova grupa in case of the registry lock would be greater than the damages being incurred by minority shareholders. This does not in any way pass a serious judicial and economic review. The costs incurred by Mercator and Fortenova grupa, such as convening and holding general meetings, the costs of legal proceedings and maintaining a bank's statement of joint and several liability, are negligible for a company as large as Mercator or Fortenova grupa compared to the damages being incurred by the minority shareholders. The minority shareholders will incur irreparable damages in case of the breaking of the registry lock as they will lose property with the value (10%) of at least EUR 100 million because, in case of the breaking of the registry lock, the applicant will have a clear path to withdraw the shares from the regulated securities market and pay the minority shareholders a mere EUR 36.00 EUR per share.

The minority shareholders would also incur irreparable damages because there is a high chance that the ownership of Mercator would quickly change again after the squeeze-out, either directly or indirectly. Consequently, in case of a successful outcome in court, the minority shareholders will need to recover the awarded additional monetary compensation from a foreign company with no property in the Republic of Slovenia, which is of course very difficult in practice.

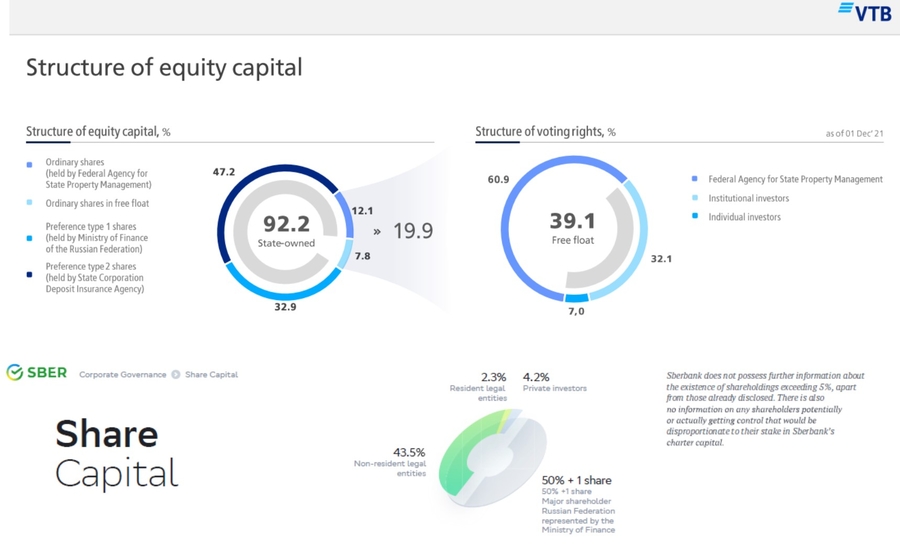

Furthermore, VZMD is particularly worried because more than 51.5% of Fortenova grupa is owned by the Russian state banks. SBERBANK, in which the Russian Federation directly owns a 50% + 1 share, owns a 44% share of Fortenova grupa, while a 7.5% share is owned by VTB Bank, in which the Russian Federation has a whopping 92.2% share. In light of the fact that Mercator and Fortenova grupa are directly majority-owned by the Russian Federation, VZMD is shocked that such a transaction has not been stopped due to the sanctions adopted previous to this. The judge Melita Štefančič therefore protected the interests of a foreign country, against which the sanctions have been adopted, while she characterized the interests of the domestic minority shareholders – in the amount of at least EUR 100 millions – as "extremely low". It is VZMD's opinion that in this case, the regulators and decision makers fell asleep because instead of quick actions, the media reported only about the announcements that there has been no suitable case for applying sanctions in the Republic of Slovenia?!?

Consequently, VZMD calls on the Court of appeal to uphold the appeal, change the contested decision of the Registry, and reject the entry, as well as annul the decision and refer the case back to the Registry court for judgment. "Due to the disastrously low monetary compensation at the squeeze-out, the damages to the minority shareholders would be enormous and irreparable, while the damages incurred by the majority shareholder and Mercator due to the failure to enter the squeeze-out would be minor, almost immaterial, and the transfer should not have been carried out anyway due to the sanctions. Therefore, there are no damages because of that compared to at least EUR 100 million in damages," summarized the VZMD President.

www.vzmd.si – More on the VZMD – PanSlovenian Shareholders' Association

www.vzmd.tv and www.investo.tv – Over 300 videos from VZMD.TV and investo.tv

www.investo.si – More on the investo.si – Invest to Slovenia Program

www.investo.international – More on the network of 75 national organizations of shareholders and investors