The PanSlovenian Shareholders' Association (VZMD) is on behalf of expropriated shareholders of Nova KBM, who joined procedures under the wing of VZMD, lodged at the Constitutional Court of the Republic of Slovenia a proposal for the issuance of a temporary decree for prohibiting the sale of NKBM, until a decision has been made regarding the Initiative for judging the constitutionality of the contentious amendment of the Banking Act (ZBan-1L). The latter namely established the foundation for expropriation close to 100.000 shareholders of NKBM – alongside the shareholders of five other Slovenian banks, collectively with 2.000 holders of subordinated bonds as well as cca. 500.000 citizens, who save in pension fund companies, trust and insurance companies.

The proposal for the issuance of a temporary decree for the prohibited sale of NKBM was lodged by VZMD via attorneyTamara Kek, as well as mentioned Initiative for judging the constitutionality of ZBan-1L - please see the VIDEO from the press conference of VZMD regarding the May 2014 lodged Initiative regarding erased stocks or in other words, on behalf of expropriated shareholders of Slovenian banks. They were able to join the procedure for the protection of their rights, interests and assets, as led by VZMD, without any kind of costs whatsoever, onlywith a signature, published on the network of VZMD, in relation to the documentsAttorney Authorization and Statement of securities ownership.

In view of numerous and diverse procedures which VZMD initiated on behalf of expropriated holders of Slovenian bank bonds - as well as with this connected intensive activities home and abroad - the VZMD president Mr. Kristjan Verbič, regarding that Proposal to the Constitutional Court once again pointed out: »On the basis of the considerably disputable and the absolutely shocking amendment to the Banking Act from the point of view of repercussions, in addition to the incredible damage to the Slovenian business-investment environment and credibility - despite funds and investment institutions, home and abroad - at the Ljubljana and Warsaw Stock Exchanges, there were more than 100.000 small, largely uninformed investors expropriated, also due to the much publicized public sale of the state's share in NKBM, as well as holders of stocks and subordinated bonds ofNLB, NKBM, Abanka and Banka Celje not to mention Probanka and Factor banka.«

In this regard, it is worth also pointing out, that on 17. November 2014 Mr. Peter Glavič, representative of the Civil Initiative »Erased Small Shareholders of NKBM«, and Mr. Verbič, to the members of Parliament of the Republic of Slovenia, directed an Initiative for the establishment of an investigative commission, which should finally uncover the questionable methodology and calculations as well as the notes of the Inter-Ministerial commission and the Steering committee. This was also supplemented by an Analysis of the happenings over the last five months and Emphases and discoveries of expert associates of the VZMD, which were otherwise sent to the National Assembly of the Republic of Slovenia already in May 2014, but were until last week unfortunately not discussed (VIDEO). The initiative, together with rationale, was also sent to the President of the Government of the Republic of Slovenia, the President of the National Council of the Republic of Slovenia, Slovenian members of the European Parliament, the Minister for Finance and to the Governor of the Bank of Slovenia

In this regard, it is worth also pointing out, that on 17. November 2014 Mr. Peter Glavič, representative of the Civil Initiative »Erased Small Shareholders of NKBM«, and Mr. Verbič, to the members of Parliament of the Republic of Slovenia, directed an Initiative for the establishment of an investigative commission, which should finally uncover the questionable methodology and calculations as well as the notes of the Inter-Ministerial commission and the Steering committee. This was also supplemented by an Analysis of the happenings over the last five months and Emphases and discoveries of expert associates of the VZMD, which were otherwise sent to the National Assembly of the Republic of Slovenia already in May 2014, but were until last week unfortunately not discussed (VIDEO). The initiative, together with rationale, was also sent to the President of the Government of the Republic of Slovenia, the President of the National Council of the Republic of Slovenia, Slovenian members of the European Parliament, the Minister for Finance and to the Governor of the Bank of Slovenia

Therefore, on 19. November 2014 they also wrote to the President of the Government of the Republic of Slovenia and the Slovenian Sovereign Holding (SDH) and suggested the pre-emptive purchase of stocks for €150 million (at that time the highest known offer). Also offered was an agreement solution for erased stocks in the paid up amount of €524 million + €64 million, taking into account interest and dividends in the years 2007-2014. Assets would be collected from expropriated shareholders and holders of subordinated bonds, funds, employees in NKBM, business entities, local communities, citizens, etc. Expropriated holders of stocks and non-subordinated bonds as well as employees would have, in the sale of NKBM, preferential purchase rights, where during the acquisition of, the state would have to take into consideration the previously taken away property.

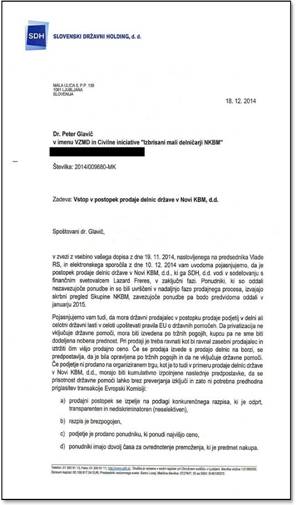

The cabinet of the President of the Government of the Republic of Slovenia sent the mentioned offer to the Ministry of Finance of the Republic of Slovenia, which on 5 December 2014 responded that it will not comment on the offer until the decision of the Constitutional Court of the Republic of Slovenia is known. Immediately upon the announcement of the extended deadline for collecting binding offers, the representatives of the Civil initiative and theVZMD directed the offer to the Slovenian Sovereign Holding. The response was received before the holidays - in which the Slovenian Sovereign Holding »cites«conditions of the European Commission – the subsequent inclusion of an additional bidder in the selling process bypassing tendered conditions could represent a problem from the point of view of the forbidden state aid. They suggested that the initiators directly contact their financial advisor Lazard Frères. This they also did, however the opportunity to hold serious discussions with the executive director Nicole Arditti came only after the holidays and unfortunately, they did not bring about satisfactory results.

»In view of the fact that it is impossible for citizens, as buyers or investors - and not only as payers, taxpaying system rescuers and expropriated persons - to participate in the procedures of the sale of state owned assets, VZMD, and with us connected civil initiatives, are all the more active in also collaborating withcommunity associations and movements 'Citizens against sell-off',«which was pointed out by Mr. Verbič during the active participation at public panel discussions»NO SELL-OFF, BUT BETTER CORPORATE GOVERNANCE« in Ljubljana and in Maribor as well as at the press conference, upon the announcement of the public assembly against the sell-off of public assets, about which the team from VZMD.tv / investo.TVprepared aVIDEO NEWS COVERAGE: the public panel discussion in Ljubljana's Cankarjev dom and the press conference in the premises of the Slovenian Academy of Sciences and Arts.

The proposal for the temporary decree for the prohibited sale of NKBM was lodged by VZMD in accordance with Article 161 of the Constitution of the Republic of Slovenia, in which the Constitutional Court may, on conditions provided by law and until the final decision in total or in part, withhold the execution of the act which constitutionality and regularity is assessed. The same authority is provided by Article 39 of the Constitutional Court Act to the Constitutional Court, stating that Constitutional Court, until the final decision in total or in part, may withhold the execution of legislation or other regulation or general act in relation to the execution of a public authority, if by nature of its execution, irreversible damage may result as a consequence. The initiators wish, with the lodging of the proposal for the temporary retainment of the state's activities in connection with the sale of NKBM d.d., which the state is executing on the basis of public authorization, on the basis of which the decision in relation to the privatization of state assets is made, to prevent irreversible and irreparable damage, which may arise on one hand to initiators and also to expropriated holders of stocks in NKBM d.d. on the basis of already declared and unconstitutional exceptional measures on the basis of the disputed arrangement according to Banking Act, and on the other hand to the bank and state, which intends to sell the respective bank for less than its book and market value, which will consequently also affect public finances and the national interest. .

The initiators were long-term owners of stocks in NKBM d.d., as during the 2007-2013 period they didn't sell; and it was long-.term investors that were espoused by the state, as per the Brochure extract for the offer of public stocks (Nova KBM, November 2007, point 5.2.7). The expropriation and erasure of stocks, executed on 17 December 2013 with the Bank of Slovenia's resolution for extraordinary measures, represents an unlawful deprivation of assets, which is in conflict with the constitution and with the Convention for the Protection of Human Rights and Fundamental Freedoms. Notwithstanding this, it also contributes to constitutional impermissible and unfair competition to foreign legal entities in comparison with local entities. The procedure for asset deprivation was connected with a number of proven, unlawful, non-constitutional and fraudulent actions of the state. Therefore, initiators to the Constitutional Court suggest that it decides for the temporary suspension of the sale of NKBM, until a decision regarding the initiative has been made.

On 18 December 2013, the Constitutional Court rejected the proposal of owners of subordinated bonds for the temporary suspension of the execution of articles of the amended Banking Act (ZBan-1L), which enabled the erasure of those securities and the expropriation of their owners. At that time the recapitalization of banks was being prepared, which the temporary decree would halt (this would have been better for the shareholders), the Constitutional Court decided on the basis of unfounded threats from the state and the Bank of Slovenia that the suspension of erasure would lead to insolvency proceedings of the three largest banks and the collapse of the entire financial system in the Republic of Slovenia. With regard to subordinated bonds, the matter concerns the bank's financial commitments with a precisely determined value both of principal and the associated interest, therefore the fair financial redress is possible at a later time.

However, the stocks are different. The value of stocks fluctuates, however they yield benefits over the long-term better than term deposits in banks. The majority of foreign stock indexes now already exceed the pre-recession level, while the Slovenian, due to poor management of the state and forced closeouts is still far from the level which it attained in years before the recession. Therefore with regard to this proposal, initiators and investors demand the return of stocks to the value of paid up assets, increased by associated interest and reduced by paid out dividends. If the bank will be sold, a normal increase in the value of the stock will no longer be possible, damaging ramifications will no longer be reparable, as the state will no longer be able to return the stocks. And 'to sell' (effectively to give away) it for a proposed third (€200 million) of its book value (which on 30 September 2014 amounted to €624 million) or a tenth of the objective obtainable value (€1,900 million), is damaging on a national level.

Already from the aforementioned it is clear that with the sale of NKBM before the decision of its initiative addressing the constitutionality of the Banking Act, for which initiators are of the opinion that it is totally reasonable, undeniably worse and disproportionate repercussions arose in comparison with benefits, which on the other side will remain with NKBM and the banking system. With regard to publicly accessible data, as already mentioned, the state intends to sell NKBM far below its book value, which means, that such a sale of a bank in state ownership is not in the interests of the state and citizens of the Republic of Slovenia.

With regard to the foregoing, the initiators are certain that to them (as well as to all other ex-shareholders of NKBM), also upon taking into account the unsuitable and constitutionally non-compliant compensation protection pursuant to ZBan-1L, in the case of NKBM's sale before the decision regarding its initiative and related lodged initiatives regarding the decision on constitutionality of ZBan-1, will be faced with undoubtedly irreversible adverse consequences. On the other hand, the damage, as already described, will be inflicted to the bank which will be sold far below its book value. In so doing, the direct damage will be also inflicted to the state and citizens of the Republic of Slovenia.

Other Related International Activities:

STRESS TESTS – new and obvious proof of the extremely unequal adjudication of Slovenian banks – are they guilty in Brussels or Ljubljana, and what are their motives? The PanSlovenian Shareholders' Association (VZMD) has called on the Bank of Slovenia (BA) and the European Central Bank (ECB) to explain, why only in Slovenia are we left to use »static«and extremely pessimistic assumptions, while in other countries and banks of the EU fresh data and »dynamic«valuations are used and even allow for

Slovenian Constitutional Court acknowledges the legal interest of 293 initiators united by VZMD who demanded a constitutional review of the Banking Act (Ljubljana, January 2013)

WORLD BANK – President of VZMD and EuroFinUse Board Member speaker of the first panel at the international conference about audit reform and the importance of audit committees (Bucharest, June 2013)

INDIA – visit of Slovenian government and business delegation – on the basis of Memorandum between ICPE and VZMD international investors' programs investo.si and investo.international also present (New Delhi, February 2013)

EXCLUSIVE VIDEO REPORT of "International Conference on Benefits and Challenges of Public Private Partnerships for improving Energy Efficiency" – key statements of prominent participants (Ljubljana, October, 2012)

VIDEO REPORT - International Conference at the Brussels Stock Exchange Stimulated Investors' Representatives and Institutions to Participate at the Investors' Week 2012 in September in Slovenia(Brussels, March 2012)

www.vzmd.si – More on the VZMD – PanSlovenian Shareholders' Association

www.vzmd.tv and www.investo.tv – Over 300 videos from VZMD.TV and investo.tv

www.investo.si – More on the investo.si – Invest to Slovenia Program

www.investo.international – More on the network of 55 national organizations of shareholders and investors – investo.international