BLED STRATEGIC FORUM – EXCLUSIVE VIDEO REPORTAGE of OECD Secretary General speech at the business lunch, where also upcoming international investors' exposition and conference, co-organized by VZMD and program investo.si – investo Expo was presented

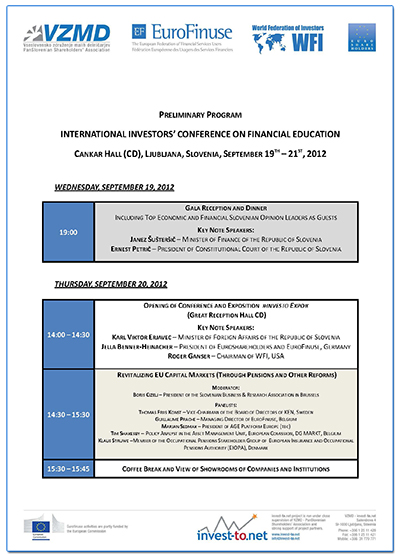

The seventh Bled Strategic Forum, which was held from Saturday under the title Europe and the New World Order, ended on Monday. Among over 400 participants from the spheres of politics, business and science from more than 50 countries, the VZMD President, Kristjan Verbič, M.Sc., also participated at the events in the context of the Strategic Forum, and at the business lunch with the Secretary General of OECD, José Ángel Gurría (organized by the Network of Ideas), and presented investo.si – Invest to Slovenia and »investors' Week« - the world's largest international meeting of investors' representatives from the 19th to the 23rd of September in Slovenia (VIDEO INVITATION click on right picture), and international investors' exposition »investo Expo« that will revolve around the main event "EuroFinuse International Investors' Conference on Financial Education"  (click for the program of the major happening at Ljubljana Cankar Hall).

(click for the program of the major happening at Ljubljana Cankar Hall).

Among the eminent guests of this year's Forum were – in addition to the Secretary General of OECD, who in his speech relatively sharplyhighlighted many major issues for the Republic of Slovenia and its citizens (click for exclusive VIDEO REPORTAGE) –President of the Republic of Slovenia, Danilo Türk, Ph.D., the Secretary General of OSCE, Lamberto Zannier, Prime Minister of Albania, Sali Berisha, Prime Minister of Kosovo, Hashim Thaci, President of the EBRD, Suma Chakrabarti, Foreign Ministers of Montenegro, Croatia, Qatar, Kosovo, Macedonia, the Palestinian Authority and Slovakia, and many representatives from the spheres of science and non-governmental organizations .

High participation confirms that with the selection of topical themes and premium speakers Bled Strategic Forum has established itself as one of the major forums in the region to discuss regional and global issues and strengthen contacts between politicians, businessmen and representatives ofprofessional and  non-governmental spheres.

non-governmental spheres.

The numerous participants were very enthusiastic about the upcoming "Investors' Week" 2012, which will be hosted by the VZMD through its investo.si – Invest to Slovenia program, and will be taking place from the 19th to the 23rd of September in Ljubljana. It will comprise of almost 100 representatives and over 55 national associations of investors and shareholders, including members of EuroFinuse – European Federation of Financial Services Users, Euroshareholders – European Organization of Shareholders Associations, and the WFI – World Federation of Investors, which together just in Europe embody over 4 million individual investors and shareholders.

(Foto: STA; OECD, Pariz 2011)

Centre for eGovernance Development for South East Europe (CeGD) released publication

Centre for eGovernance Development for South East Europe (CeGD) released publication

.jpeg) Representatives of VZMD took the opportunity of the visit especially for the integration of Slovenian and Brazilian companies at the international investors' exposition and "investo Expo" conference, that will be organized within the "investors' Week" and the

Representatives of VZMD took the opportunity of the visit especially for the integration of Slovenian and Brazilian companies at the international investors' exposition and "investo Expo" conference, that will be organized within the "investors' Week" and the  During a number of bilateral meetings and conferences Mr. Verbič and Mrs. Kavšek arranged reestablishment of the direct connection among investors' exposition and conference "

During a number of bilateral meetings and conferences Mr. Verbič and Mrs. Kavšek arranged reestablishment of the direct connection among investors' exposition and conference " In addition, the two representatives of VZMD attended the reception at the famous Slovenian-Brazilian family Hlebanja, where the delegation members met with a number of Slovenian businessmen in Brazil and Brazilian businessmen to cooperate with Slovenia, and with Mr. Žerjav visited a brand-new showroom of Gorenje, which was established by a renowned Slovenian businessman Drago Urankar or Urankar Brasil company and his colleagues on the elite Avenida Brasil.

In addition, the two representatives of VZMD attended the reception at the famous Slovenian-Brazilian family Hlebanja, where the delegation members met with a number of Slovenian businessmen in Brazil and Brazilian businessmen to cooperate with Slovenia, and with Mr. Žerjav visited a brand-new showroom of Gorenje, which was established by a renowned Slovenian businessman Drago Urankar or Urankar Brasil company and his colleagues on the elite Avenida Brasil.