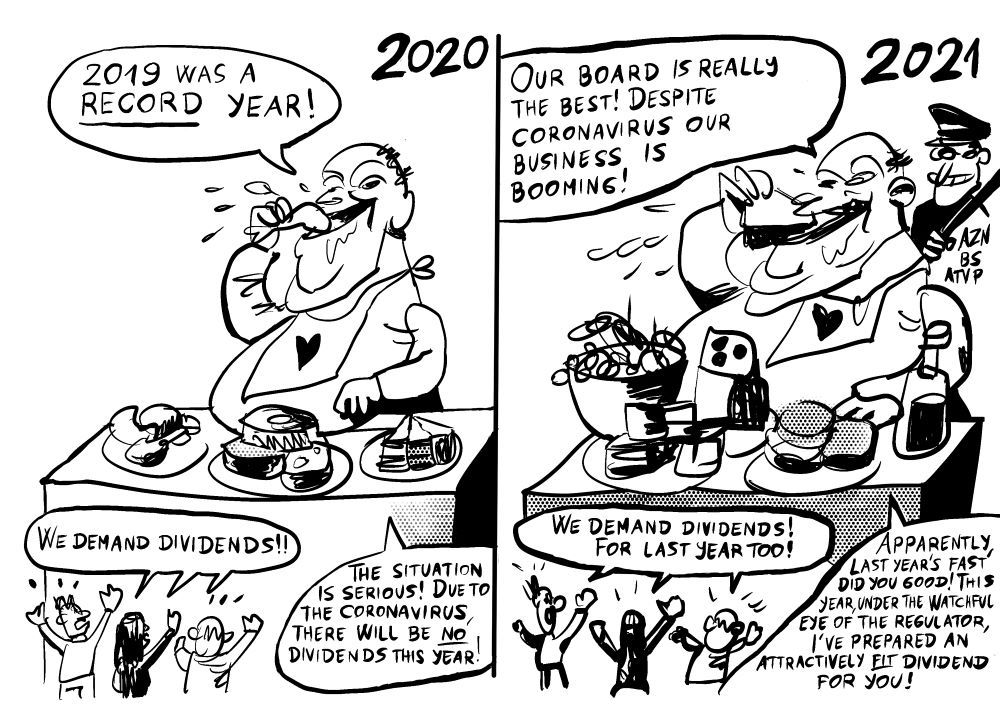

Immediately after the general meeting of ZAVAROVALNICA TRIGLAV, d.d. (main Slovenian insurance listed company) was convened, the PanSlovenian Shareholders' and Investors' Association (VZMD) sent the company a counter proposal for distribution of higher dividends – as VZMD announced recently. VZMD’s proposal thus provides for a distribution of €79,573,018.00 €, i.e. a dividend in the gross amount of €3.50 per share, while the management and the supervisory board proposed a dividend in the gross amount of €1.70 per share, meaning that the company would allocate €38,649,751.60 of a total of €89,624,175.26 € of balance sheet profit at the end of 2020. The Association believes that – since the dividends were not paid out last year – it would be appropriate and imperative for the company to allocate the majority of its balance sheet profit for the distribution of dividends to the shareholders. According to VZMD, a higher dividend would strengthen the trust of the existing and potential investors in the company's shares – in Slovenia as well as abroad – and it would consequently have a positive impact on greater liquidity and the growth of the share price on a stock exchange. The companies listed at the Ljubljana Stock Exchange that acted in this direction (e.g. Petrol, d.d. (VIDEO) and Krka, d.d.) have achieved a significant growth on the stock exchange in this period – also due to this fact.

VZMD further added that they cannot consider the dividend proposed by the management and the supervisory board – in the gross amount of €1.70 per share – to be “attractive” as claimed by the company. This dividend is even below the amount that could have been proposed by the company when taking into account the – highly questionable – recommendations and limitations by the Insurance Supervision Agency(AZN). From 2015 to 2019, the company distributed dividends in the gross amount of €2.50 per share. Although prior to the “corona crisis” in 2019, Zavarovalnica Triglav distributed dividends in the amount of €56.8 million – out of €66.8 million of the balance sheet profit for 2018 – this year’s proposal by the management and the supervisory board allocated only €38.6 million for shareholders’ dividends out of €89.6 million of the balance sheet profit.

Considering the fact that in the last year – despite the successful performance in 2019 – the shareholders received no dividends at all and that in 2020, the Group managed to collect even more premiums than before the “corona crisis”, VZMD expected the company to “make up for it” to the shareholders by drafting a proposal that would go in the direction of a double dividend (not a decreased one!).

In light of certain recommendations, demands and even general instructions of individual institutions and associations regarding the non-distribution of dividends that appeared again this year, VZMD pointed out once more that the decision on the distribution of dividends lies in the hands of the owners. They have also have repeatedly called on the institutions and associations that give such warnings to publish the relevant analyses and information based on which they take such an unfounded and harmful position – as is a firm belief of VZMD and the European Federation of Investors and Financial Services Users (Better Finance). With respect to the foregoing, they have not yet received any sound analysis that would justify such decisions with extremely far-reaching consequences. On the contrary – the time has shown thatduring the “corona crisis”, the company was even more successful, therefore it could have distributed the dividends in last year as well, i.e. for 2019.

VZMD is closely following the situation and the influence of the “corona crisis” on other public limited companies, from which Slovenian shareholders will receive quite different rewards for their capital investments or rather their “company loyalty” – despite the pleasant fact that most of them performed quite well. Based on the published proposals of the managements and supervisory boards regarding the distribution of dividends, it is becoming clear that many companies do not wish to give their shareholders the appropriate dividends that would reflect the good results from one and two years ago, the positive forecast for the future and the fact that many shareholders have already been – unjustifiably – deprived last year, and the same applies to the budget of the Republic of Slovenia as well.

www.vzmd.si – More on the VZMD – PanSlovenian Shareholders' Association

www.vzmd.tv and www.investo.tv – Over 300 videos from VZMD.TV and investo.tv

www.investo.si – More on the investo.si – Invest to Slovenia Program

www.investo.international – More on the network of 75 national organizations of shareholders and investors