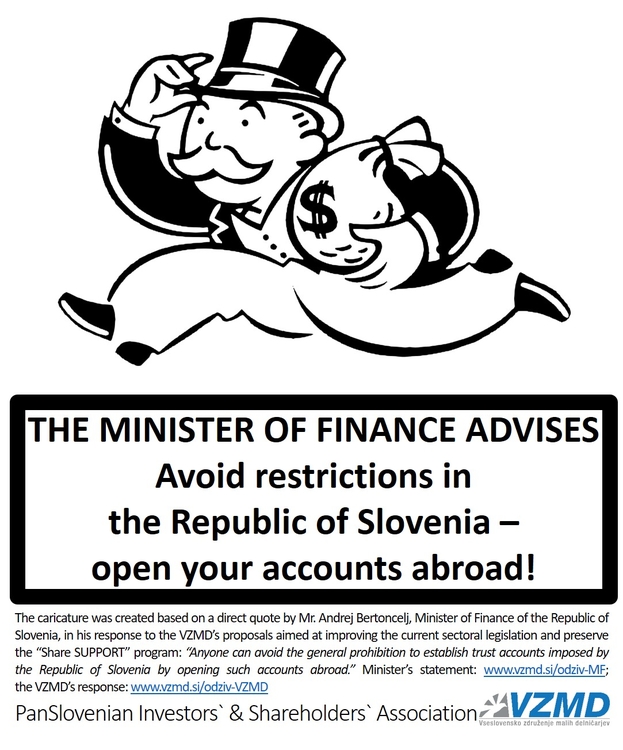

It looks like the scandalous positions assumed by the Ministry of Finance of the Republic of Slovenia and the Securities Market Agency (ATVP) are shifting from modest silence (as for example in the case of calls for deterring craftsmen and entrepreneurs, and threats of nationalization) to concrete actions, as they advise shareholders, who are not fond of the proposed legislation, uniquely suited to financial elites, to transfer their accounts abroad! The Minister of Finance Mr. Andrej Bertoncelj, namely responded to constructive and well-supported suggestions by the VZMD by flatly expressing the following position: "Anyone can avoid the general prohibition to establish trust accounts imposed by the Republic of Slovenia by opening such accounts abroad." It has been a long time since such words last echoed on our ground, more precisely since the times of the Meeting of Truth at the Ušće in Belgrade, Serbia, when Mihajlo Švabić urged “disobedient” Slovenes to leave the country: »All those Slovenes who are not in favor of contemporary Serbia and the brotherly united Yugoslavia, may as well move to Graz or Philadelphia.« Back then we had enough reason and sense of unity to ban such meetings in Slovenia. Should we now fall prey to an identical attitude acquired by our elected representatives and special agencies?! But the Ministry of Finance doesn’t stop there with its tips and tricks, as they act contrary to the European rules (Article 38 of the Regulation (EU) No. 909/2014), which expressly prohibit imposing additional restrictions on trust accounts in addition to those not valid on September 17, 2014.

For a long time, the VZMD -together with their colleagues from the European Federation of Investors (Better Finance) - have persistently warned about the by-ways of the Slovene legislation, which, as opposed to environments striving to attract domestic and foreign investors, are more focused on protecting financial intermediaries from minority shareholders than vice versa. On the occasion of adopting the new Financial Instruments Market Act (ZTFI-1), which the financial authorities are in a rush to adopt under urgent procedure and without a public hearing, the VZMD’s associates have pointed out three areas that seem particularly questionable for minority shareholders:

- applying arbitrary limitations to schemes and programs established to protect minority shareholders, primarily the "Share SUPPORT", which in two years since its founding, has helped over 2,200 Slovene minority shareholders, 1,200 of which already reaped some profitsin the total amount of € 370,000 from selling “worthless” shares;

- financial intermediaries reselling shareholders and investors to one another, as if they were objects or goods lacking their own will and personality;

- financial intermediaries charging provisions for each dividend payout, which for minority shareholders often exceed the amounts paid as dividends.

For each of the above issues, the VZMD prepared constructive and well-supported proposals to amend ZTFI-1 and efficiently address the unnecessary troubles having adverse effects on society at large. Whilst the Ministry of Finance together with the ATVP responded to the proposals formulated by the VZMD, the contents of their response indicate a critical ignorance of the matter, which one would not expect from experts, whose supposed task is to protect investors. Therefore, the VZMD expresses its concern that there is in fact a deeper cause for the firmly rooted favoritism of financial oligarchs! This is why the VZMD’s associates firmly reject the response from the Ministry of Finance and the ATVP, and call to end this ignominious practice of instrumentalizing the Financial Instruments Market Act to subject it to the never-ending ambitions of the ATVP as an obvious transmission of the financial industry (VIDEO from the meeting of the Finance Committee on October 28th 2016), which aims to prevent minority shareholders to effectively unite under any other expert organization outside the tight (or suffocating) embrace of financial intermediaries. Since two years ago, when the VZMD together with the expert help from lawyers established the "Share SUPPORT" scheme, (VIDEO) the ATVP directs its attempts to eliminate it (VIDEO from the Financial Committee meeting on February 2nd 2017) with more and more legislative changes, which are blindly followed by the Ministry of Finance.

How many more times will the ATVP change the legislation that applies to lawyer’s trust accounts for securities (also used by "Share SUPPORT"), before it finally in its role of regulative authority and expert finds an expert solution that will be applicable at least more than a year?! The VZMD notes that it was the ATVP to request the change of the legal regulation of the lawyer’s trust accounts already in 2017 (Official Journal of the Republic of Slovenia no. 9/17 from February 24th 2017). Was the Agency in 2017 not familiar with the reasons to which it refers right now? Or maybe the real reason is that the said change did not reach its real goal, which was to destroy "Share SUPPORT" – a thorn in the side of financial oligarchs and their militia of officials? With the current legislative proposal the ATVP and the Ministry of Finance wish to limit the duration of the "Share SUPPORT" to 12 months – the same period that applies for lawyer’s trust accounts. Such limitation is arbitrary and unique compared to other EU members. What's more, such limitation is nonpareil in Slovenia as well, since no limitations apply to the duration of lawyer’s trust accounts. A lawyer representing shareholders as sellers, is obligated to carry out the sale with expert diligence. If lawyers have to mind a time limitation, this could impose significant limitations to their work in general. This, of course, will benefit the opposite parties (potential buyers), who are aware of the time limitation and exert additional pressure on sellers. In addition, the Republic of Slovenia or its Ministry of Finance should be acutely aware of the fact that selling “under pressure” never yields optimal results.

As stated at the beginning, the repressing proposal from the Ministry of Finance goes as far as to expressly contradict European rules, since it disregards the fact that Article 38 of the Regulation (EU) No.909/2014 prohibits imposing additional restrictions on trust accounts in addition to those not valid on September 17th 2014. While the Ministry of Finance doesn’t know how to respond to the justified criticism by the VZMD with regard to non-compliance of the proposal to limit lawyer’s trust accounts with European rules, it doesn't hesitate to respond in lines with the previously cited positions acquired from the Meeting of Truth, namely that: “Anyone can avoid the general prohibition to establish trust accounts imposed by the Republic of Slovenia by opening such accounts abroad.” Such statements surely go beyond the discussion about the proposed amendments from the VZMD and call for a broader debate about the values, objectives, and accountability of officials, who fail to find such positions questionable.

Another issue that deserves to be addressed within a broader discussion are the manipulative statements by the Ministry of Finance according to which the regulation of lawyer’s trust accounts would enable a more efficient securities enforcement. According to publicly available data, there is somewhere around a few € 100,000 and in any case not more than a few million € worth of assets on lawyer’s trust accounts in the entire Republic of Slovenia. Meanwhile, trust accounts of big (and foreign) financial intermediaries contain several billion euros worth of Slovene securities. That said, one may ask, what exactly have the Ministry of Finance and the ATVP done up until now to enable a more efficient enforcement directed at these trust accounts? If they failed to do anything and these accounts really represent a big issue in terms of enforcements, then no current office-holder deserves to retain their post for much longer. In fact, ten full years had passed, before they decided to take action directed at the lesser (exclusively domestic) part of lawyer’s trust accounts, since there are not many foreign lawyers and notaries in Slovenia. On the other hand, trust accounts of foreign financial moguls, which contain AT LEAST A THOUSAND TIMES GREATER ASSET, are left untouched! If, on the contrary, lawyer's trust accounts do not pose a problem in terms of enforcements, this is obviously just a misleading attempt to intimidate with safety risks, which only exist in the heads of the financial industry militia.

Another sore point of the minority shareholders, who are victims of systemic abuses, are the disgraceful practices of brokerage companies and banks which resell shareholders as if they were bags of potatoes and, of course, in turn receive big sums in commissions, which could very well go to shareholders in the form of (lower, that much is true) compensations. The VZMD's proposal was that brokerage companies should not be entitled to any payment from the financial intermediary for transferring their clients according to Article 187 of the ZTFI-1. In addition, the VZMD suggested that the brokerage companies should not charge any compensation in connection to such transfers, even if the client/shareholder chooses to transfer to another brokerage company in case that the current financial intermediary (deliberately!) decides to cease their activity.

The Ministry of Finance and the ATVP continue to shamelessly apologize and justify the existing situation by stating that this is a contractual relationship between two legal entities, or a relationship between a client and their brokerage company. How can this be deemed a contractual relationship, if the shareholder is deprived of any influence on the decision made by the financial intermediary to cease its activities and sell the shareholder to another intermediary?! What kind of contracts do the advocates of the financial industry have in mind when one contractual party entering such contract is denied all rights? Furthermore, when a shareholder wishes to deliberately transfer to another financial intermediary, they incur disproportionate (punitive) costs, regardless of the fact that the rise of the need to change financial intermediary has nothing to do with them. How could it be that in the Republic of Slovenia we understand the concept of free choice of service and the pertaining right of the consumer to change providers with little to no cost in areas such as electric power supply, telecommunications, and even banking, while the Ministry of Finance and the ATVP deny such rights to consumers wanting to change their financial intermediary in the field of securities brokerage, with which they stifle competition?! Is contractual freedom a concept that is alien to the areas of electric power supply, telecommunications, and banking? Or is it merely that minimal legal safety-nets need to be applied to protect the weaker party so that “contractual freedom” doesn’t degenerate into something that would only give rights to the stronger party? How can it be that these severe problems are being addresses solely due to the VZMD’s persistent efforts and warnings, and that the Ministry of Finance or the ATVP do nothing on their own to regulate the area, which would put an end to the practice of treating people as assets from a balance sheet?

Moreover, the Ministry of Finance doesn’t take seriously the issue, which is unique to Slovenia – charging fees for single payouts by financial intermediaries. In addition, the Ministry fakes ignorance and deceives by saying that the current legislation offers shareholders the possibility to combine payouts to reduce the disproportional compensation costs incurred to them. Even if minority shareholders had the possibility to reach an agreement with the brokerage company, which would be different from the one defined by law, in practice the realization of such arrangement would depend entirely on the arbitrary decision made by the financial intermediary. In fact, an agreement which would derogate from the legal regulation, would only be possible with the consent of the brokerage company, which means that the Ministry of Finance offers shareholders a “handout” from the financial intermediaries instead of codified rights, which the financial intermediaries would have to follow even against their wishes! Only by codifying this legal right, all shareholders would have the possibility to exercise it. The VZMD immediately verified the guarantees made by the Ministry of Finance, which said that it is possible to reach an agreement on joint payouts to reduce the costs of separate payouts. However, the exact same brokerage company, which the Ministry indicated as the one to enable such practice, responded (as expected by the VZMD) that this is in stark contrast to the guarantees made by the Ministry. The brokerage company explicitly wrote that they “do not carry out billing and payout in this manner”, which means that the guarantees given by the Ministry of Finance are merely a dead letter reflecting complete ignorance of the matter and that the Ministry turns a blind eye to the untenable and adverse current situation. That said, it is of vital importance that the amendment proposed by the VZMD be adopted.

In so doing, the Ministry of Finance and the ATVP, with their attempt to gloss over the increasingly evident fact indicating their favoritism, showed their true colors. At this point, only the upright stance of the members of the National Assembly of the Republic of Slovenia may prevent further abuse of shareholders and investors by financial oligarchs, who are backed by the “act”. Namely, the Bill on ZTFI-1 (the new act containing no less than 562 articles!), which was supposedly prepared by the Ministry of Finance and the ATVP, didn’t see a single comment from the financial intermediaries! After the public announcement of their amendments to the proposal for the ZTFI-1, the VZMD presented the thorny issues, arguments, and experience gained by working directly in this area for 13 years, at the National Assembly of the Republic of Slovenia to the representatives of the parties SD, SDS, and NSi, which have responded to their appeal. At the DeSUS party, they thanked the VZMD for their initiative and refused the meeting since "VZMD’s representatives will get the chance to present their views," at the upcoming meeting of the Financial Committee. At the VZMD, they advocate reasonable and factual arguments, which they hope will prevail at the meeting of the Financial Committee of the National Council of the Republic of Slovenia.

Other Related International Activities:

INSTANT DISMISSAL OF GOVERNOR! - reaffirmation of VZMD's shocking analyses and statements in regard to the billion-euro "Plunder of the century" during the bank "restructuring" and direct responsibility of the National bank of Slovenia executives for enormous damages to the citizens and the Republic of Slovenia

EXCLUSIVE VIDEO REPORT from the meeting of the Committee of the Slovenian National Council which unanimously took VZMD’s side after facing off with the Securities Market Agency (ATVP) and the Ministry of Finance regarding the disputable Article 25 of the amending act to the Financial Instruments Act

CONSTITUTIONAL COURT - VZMD also lodged a proposal for the temporary decree for PROHIBITING THE SALE OF Nova KBM bank - to prevent direct damage to the Republic of Slovenia and its citizens

STRESS TESTS – new and obvious proof of the extremely unequal adjudication of Slovenian banks – are they guilty in Brussels or Ljubljana, and what are their motives? The PanSlovenian Shareholders' Association (VZMD) has called on the Bank of Slovenia (BA) and the European Central Bank (ECB) to explain, why only in Slovenia are we left to use »static« and extremely pessimistic assumptions, while in other countries and banks of the EU fresh data and »dynamic« valuations are used and even allow for

Slovenian Constitutional Court acknowledges the legal interest of 293 initiators united by VZMD who demanded a constitutional review of the Banking Act (Ljubljana, January 2013)

WORLD BANK – President of VZMD and EuroFinUse Board Member speaker of the first panel at the international conference about audit reform and the importance of audit committees (Bucharest, June 2013)

INDIA – visit of Slovenian government and business delegation – on the basis of Memorandum between ICPE and VZMD international investors' programs investo.si and investo.international also present (New Delhi, February 2013)

EXCLUSIVE VIDEO REPORT of “International Conference on Benefits and Challenges of Public Private Partnerships for improving Energy Efficiency” – key statements of prominent participants (Ljubljana, October, 2012)

VIDEO REPORT - International Conference at the Brussels Stock Exchange Stimulated Investors' Representatives and Institutions to Participate at the Investors' Week 2012 in September in Slovenia(Brussels, March 2012)

www.vzmd.si – More on the VZMD – PanSlovenian Shareholders' Association

www.vzmd.tv and www.investo.tv – Over 300 videos from VZMD.TV and investo.tv

www.investo.si – More on the investo.si – Invest to Slovenia Program

www.invest-to.net – More on the network of 65 national organizations of shareholders and investors – invest-to.net