Constitutional Court of the Republic of Slovenia at the meeting held on Wednesday, December 18th, adopted a decision to accept into hearing the initiatives for constitutional review of the Banking Act (ZBan-1L), which were proposed on 4th and 10th December by the Pan-Slovenian Shareholders' Association (VZMD) which submitted the initiatives through Kunič Law Office in the name of 290 holders of bonds. The Constitutional Court accepts for hearing only those initiatives whose initiators have expressed legal interest, and the judges of the Constitutional Court have rejected statement made by the Slovenian Government which has been claiming that the initiators do not show legal interest and therefore the Court should dismiss their initiative.

The Constitutional Court has also accepted the suggestion of the initiators that their initiative should be treated preferentially. It has even decided that the initiative will be treated with absolute precedence, which means that the procedure of the constitutional review of the amending act continued on Wednesday.

Unfortunately, the Constitutional Court has rejected the proposal of initiators to withold the implementation of this statute until the Court's final decision is made. It seems that the misleading claims of the Slovenian Government, the Ministry of Finance and the Bank of Slovenia about the »catastrophic consequences«and »jeopardy of the entire financial system in the Republic of Slovenia«which would be the result of such witholding, along with the fact that the holders will only have »material«consequences, convinced the Constitutional Court Judges that the proposed witholding is not necessary.

The cancellation of shares and subordinated bonds of the Slovenian banks has already taken place, synchronously with the Constitutional Court Session. A-bank has informed its investors that their shares and subordinated bonds do not exists any more at 15:47, NLB has done a similar thing at 16:51, and NKBM at 19:12.

The cancellation of shares and subordinated bonds of the Slovenian banks has already taken place, synchronously with the Constitutional Court Session. A-bank has informed its investors that their shares and subordinated bonds do not exists any more at 15:47, NLB has done a similar thing at 16:51, and NKBM at 19:12.

None of the three banks or boards thought it would be appropriate to express their regret, let alone apologize to their investors and creditors – A-bank board has in the previously mentioned statement even ludicrously written that A-bank »as a bank important for the system, with stable operating profit, will continue to pay special attention to ensure security and stability of operations".

Before the Wednesday's session of the Slovenian Institutional Court VZMD submitted to the Institutional Court of the Republic of Slovenia through Kunič Law Office in the name of 290 holders of bonds the initiatives for constitutional review, or a written reply to the statement by the Slovenian Government about both VZMD initiatives for constitutional review of the Banking Act (ZBan-1L). VZMD has, with these two initiatives, also suggested witholding implementation of disputable amending act. Some VZMD experts think that this opinion - which the Slovenian Government adopted and published on Friday, 13th December 2013, after being asked by the Constitutional Court to make its stand on the initiatives for constitutional review - is absolutely misleading.

Another initiative has been added to the above mentioned initiatives, namely the demand of the National Council of the Republic of Slovenia for the constitutional review, and VZMD has emphasized that the Constitutional Court of the Republic of Slovenia may indeed reject the initiatives, whereas the National Council of the Republic of Slovenia has been qualified for proposing cases which the Constitutional Court has to deal with. Like VZMD, the National Council has expressed its opinion that a few ZBan-1L provisions are not in accordance with the constitutionally guaranteed rights of the citizens. Thus an especially problematic provision is the one that, in case of state bank recapitalisation, enables cancellation of debts of all those bank creditors who could, in the case of bankruptcy in the sequence of repaying bank's liabilities, have their turn after the holders of bank deposits and senior bonds. There are two other provisions which are rather questionable: a provision that forbids the expropriated creditors to bring a suit against the bank, and a provision which declares as null guarantees in brochures that the risk of non-payment to the holders of subordinated bonds can take place only in case of bank bankruptcy.

Another initiative has been added to the above mentioned initiatives, namely the demand of the National Council of the Republic of Slovenia for the constitutional review, and VZMD has emphasized that the Constitutional Court of the Republic of Slovenia may indeed reject the initiatives, whereas the National Council of the Republic of Slovenia has been qualified for proposing cases which the Constitutional Court has to deal with. Like VZMD, the National Council has expressed its opinion that a few ZBan-1L provisions are not in accordance with the constitutionally guaranteed rights of the citizens. Thus an especially problematic provision is the one that, in case of state bank recapitalisation, enables cancellation of debts of all those bank creditors who could, in the case of bankruptcy in the sequence of repaying bank's liabilities, have their turn after the holders of bank deposits and senior bonds. There are two other provisions which are rather questionable: a provision that forbids the expropriated creditors to bring a suit against the bank, and a provision which declares as null guarantees in brochures that the risk of non-payment to the holders of subordinated bonds can take place only in case of bank bankruptcy.

However, the Slovenian Government in its Press Release keeps pretending ignorance, because it simply states that »challenged articles do not interfere with the rights of investors«(?!), that it will be possible to eliminate the »consequences of the challenged articles by constitutional appeal«(after previous constant assurances that it will not be necessary to abolish the consequences, because none of them is against the law), that in case of witholding ZBan-1L »procedures of bank assistance will be in contrast with the EU legislation about bailouts«and it has once again concealed that the guidelines of the European Commission from 1st August 2013 are not binding, and the directive is to be made in the following year, and the member states are to enforce it on 1st January 2018, and on top of that in Article 35, which defines bank measures for gathering capital, they talk about the »voluntary transformation of the subordinated instruments into capital on the basis of stimulation«! The Government of the Republic of Slovenia furthermore in the publicly published material – contrary to the principles regarding protection of personal data – reveals the name of the initiator of the constitutional review, a member of the VZMD Expert Council, Tadej Kotnik, PhD, and it gives to the Constitutional Court a statement that the »initiators do not show any legal interest to challenge ZBan-1L«. Although the assessment of legal interest is not the government's domain, VZMD is wondering if the government of the Republic of Slovenia is not familiar with the fact that the initiative was also filed in the name of NLB bond holders of 26th issue – NLB announced last Thursday that the holders of all NLB d.d. subordinated bonds will have their bonds cancelled, in full and without any compensation?! Apart from that VZMD also emphasizes the A-bank announcement stating that all holders of subordinated bonds will lose their entire investment, also by cancellation, which is – according to the claims by the Ministry of Finance of the Republic of Slovenia – necessary for establishing enough capital for A-bank operations, and the following day A-bank announced that it will invest 5 million EUR of capital into Argolina d.o.o. company which is involved in »investment engineering«!!!

The Government of the Republic of Slovenia in its Statement - sent to the Constitutional Court of the Republic of Slovenia regarding the VZMD proposal for temporary witholding ZBan-1L, given in the framework of U-I-295-13 initiative – is trying to argue the point that witholding ZBan-1L is dangerous on the basis of 8 claims which are, as paragraphs, stated twice: first in point 5 of the summary of material, and then again on the 1st page of the Statement itself, and later it tries to justify these claims one by one.

Therefore we have decided to publish a reply or arguments of some VZMD experts related to the Statement of the Slovenian Government, according to the individual claims:

1.) The Government claims that »the challenged articles do not interfere with the rights of investors«. Provisions regarding writing-off qualified obligations of a bank which have been entered in ZBan-1 with the amending act ZBan-1L provide that, in case any of the Slovenian banks gets State aid, debts of all those creditors of the bank who were, in case of its bankruptcy in the sequence of paying bank liabilities placed after the holders of bank deposits and ordinary bonds, are simply cancelled. NLB bank has already officially announced that such a measure will befall all holders of subordinated bonds of this bank by using ZBan-1L. The measure of cancelling subordinated bonds before implementing ZBan-1L was not possible even when bank went bankrupt, because bankruptcy does not terminate any of the debtor's liabilities, only the way of their payment changes. In regular operations debts are paid until their due date, in bankruptcy in the order of their subordination – first prior claims (salaries due), then regular (in banks these are deposits and ordinary bonds), then subordinated (subordinated bonds, then hybrid bonds, at the end shares). If there is a lack of bankruptcy mass, then some creditors are left without payment, however not without their debts – if at any time after the end of the bankruptcy procedure some non-registered property of a debtor is found, this is also used for payment of debts which have not been paid yet. Therefore, according to our opinion, it is clear that the intervention into the rights is present and very obvious.

2. and 3.) The government claims that »the consequences of the challenged articles can be abolished by constitutional complaint«and that »the consequences will only be of material nature«. This is in contradiction with the Government's claims made so far, namely that it will not be necessary to abolish ZBan-1L consequences, because none of them is against the law. Now the Government allows that there will be some consequences which will be against the law, but it says that they will be »only material«- therefore they can be abolished by compensation. It is difficult to judge all the consequences that can have unlawful confiscation of an important part of someone's property. In case of legal entities this can lead to insolvency and consequently to bankruptcy and termination of business operations, including the termination of employment of all employees, which can be difficult to solve with compensation.

4.) The Government claims that "ZBan-1L requires that the creditors, whose claims were the subject to a measure, do not have losses that are bigger than the losses they would have in case of bank's bankruptcy«. NLB, d.d., announcement from 12 December, cited under item 1, explicitly states that the use of ZBan-1 »probably means writing-off of all currently valid subordinated instruments at NLB d.d.«STA has also already reported that subordinated NLB d.d. creditors will lose an entire investment with this measure. Thus the Government's claim could only hold true if, in case of NLB bankruptcy and the use of all valid legal provisions, none of the subordinated creditors of this bank received any payment.

However, that this, in case of subordinated bonds of NLB d.d. as an issuing bank, is not true, can be proved by a simple calculation: if NLB d.d. went bankrupt, then all loans given to this bank by the state (Republic of Slovenia) as its main owner, would turn into bank's assets, according to the 498 Article of the Companies Act (ZGD-1). According to the latest accounting statements from 30 September 2013 the state had in NLB, d.d. a deposit in the amount of 1.36 billion euros, which means that even if, in case of insolvency NLB capital was negative in the amount of 1.36 billion euros, the capital would with this conversion again reach point zero, which in terms of bookkeeping suffices that all creditors of the company are entirely paid, including those most subordinated ones. In principle it is possible that there were additional losses that would arise as a result of cashing bankrupt's estate, but on the day NLB, d.d. officially announced that its subordinated creditors will be entirely expropriated of their claims, its capital definitely was not so deeply negative, even it had been calculated according to the most unfavourable scenario of stress tests. The amount of NLB, d.d. capital calculated in stress tests was not publicly announced, but a statement that, even if considering the most negative scenario with capital increase in the amount of 1.9 billion euros, a 15% capital adequacy of this bank will be achieved, which means that with such capital increase, even with such scenario, NLB, d.d. capital would be approximately 1.7 billion euros (15 per cent of bank resources in the total amount of 11 or 12 billion euros), which means that without this capital increase, this capital would be negative in the amount of approximately 200 million euros. If this negative capital was the reason for NLB, d.d. bankruptcy procedures, the transformation of state deposit, as defined in Article 498 of ZGD-1, would place capital back on the positive level, in the amount of more than a billion euros, which definitely would be enough to pay off all creditors, even those most subordinated ones.

5.) The Government claims that »all procedures regarding aid to banks will run into difficulties, if they are carried out contrary to the rules of the European Union regarding State aid«. The Government has in this claim again »overlooked«the fact that the guidelines of the European Commission are not binding; only a directive which is a technical legal document with unambiguous and precisely defined terminology, and which is formed on the basis of non-technical guidelines, represents binding instructions that provisions of this directive need to be enforced in national legislation of the EU member states. In case of guidelines regarding State aid to banks, the directive is to be formed in the following year, and member states are to put it into force on 1st January 2018, and until then this directive is not to be binding.

In addition to this the guidelines in the report of the European Commission regarding the use of rules about State aid to banks that the Government refers to, in Article 35, which defines bank measures for collecting capital, talk about »voluntary transformation of subordinated instruments into capital on the basis of an incentive«, and ZBan-1L defines that this transformation, without the owners' will or negotiations with them, be ordered by the Bank of Slovenia, and it can also substitute it by a compulsory write-off – also in its entirety, which was in NLB, d.d. public statement cited in item 1, already officially announced.

6.) The Government claims that »banks have to be aware of the fact that breaking the rules of the European Union means that the European Union will demand that countries return financial means which were unlawfully received, which means that rehabilitation of bank system will not be successful«. This claim repeats the thesis that the guidelines are law, which is not true; even a directive is not a law, but only an injunction which indicates that provisions of a directive need to be enforced by a law, and by enforcing a law in the national legislation the use of these provisions becomes binding, and it is against the law if we do not use them.

7.) The Government claims that »the financial resources which the country has at disposal at the moment may be insufficient, and it will not be possible to ensure capital adequacy of banks«. State Secretary at the Ministry of Finance officially declared on 29 November that:«4.7 billion euros will be the maximum amount invested into banks«. When the results of stress tests were announced they said that the State will contribute 3.01 billion euros for bank recovery of NLB, NKBM and A-bank, for capital increase of Probanka and Factor Bank 441 million euros, and for capital increase of bad bank (DUTB) additional 200 million euros, therefore 3.65 billion euros altogether. An entire subordinated debt of the Slovene banking system totals 800 million euros – subordinated debt of the previously mentioned banks is lower – therefore it is clear that because this debt will not be written off, the required financial means from the current 3.65 billion euros cannot exceed 4.7 billion euros.

8.) The Government claims that »emergency measures needed for the recovery of bank system will not be implemented«. This also is not true, because the government can carry out all other measures which can be implemented by using all provisions of the Measures for Strengthening Bank Stability Act (ZUKSB) and all ZBan-1 provisions which have been in use before ZBan-1L was introduced.

Friday's International Conference at the Madrid Stock Exchange was attended by numerous representatives of different companies and institutions, as well as by the following eminent guests: the President of the Madrid Stock Exchange Antonio Zoido; the President of the Association of the Spanish Issuers of Securities and a Board member of the power multinational enterprise ENDESA Salvador Montejo; the Director of the European Commission Representation; Nadia Calviño, a representative of the European Commission; Francisco seca, ex−President of the Spanish Parliament; José Bono, the President of EuroFinUse; Jean Berthon, the EuroFinUse Executive Director; Guillaume Prache, AEMEC Secretary General and a co−founder of the renowned law firm Cremades & Calvo-Sotelo; Wilfried Hübscher, vice−president of the World Federation of Investors; Lourdes Centeno, Vice−President of the Spanish National Securities Market Commission, and many others.

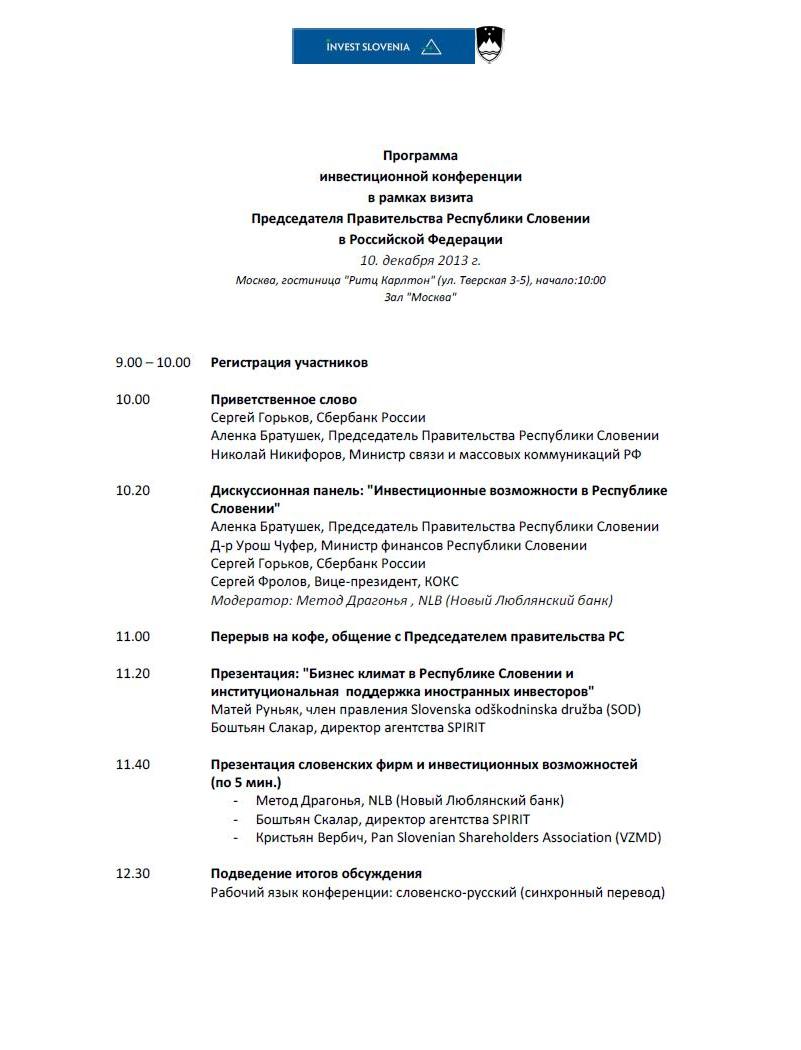

Friday's International Conference at the Madrid Stock Exchange was attended by numerous representatives of different companies and institutions, as well as by the following eminent guests: the President of the Madrid Stock Exchange Antonio Zoido; the President of the Association of the Spanish Issuers of Securities and a Board member of the power multinational enterprise ENDESA Salvador Montejo; the Director of the European Commission Representation; Nadia Calviño, a representative of the European Commission; Francisco seca, ex−President of the Spanish Parliament; José Bono, the President of EuroFinUse; Jean Berthon, the EuroFinUse Executive Director; Guillaume Prache, AEMEC Secretary General and a co−founder of the renowned law firm Cremades & Calvo-Sotelo; Wilfried Hübscher, vice−president of the World Federation of Investors; Lourdes Centeno, Vice−President of the Spanish National Securities Market Commission, and many others.  The VZMD President Mr Kristjan Verbič, M.Sc., also attended the events in the framework of the activities and endeavours of the international business-investment programmes Invest to Slovenia - investo.si and International Investor` Network - investo.international. Mr Verbič, also a member of the EuroFinUse Board of Directors, used this opportunity for numerous bilateral and multilateral talks. In this context this has been his fourth visit to Madrid, after participating there at the following past events: last year's international conference of the World Federation of Investors (WFI) and the conference of the International Financial Litigation Network (IFLN), AEMEC Congress and a meeting with the Santander Bank management team in 2011, and the General Assembly of the European Association of Shareholders (Euroshareholders) at the Chamber of Commerce and Industry in Madrid in 2010.

The VZMD President Mr Kristjan Verbič, M.Sc., also attended the events in the framework of the activities and endeavours of the international business-investment programmes Invest to Slovenia - investo.si and International Investor` Network - investo.international. Mr Verbič, also a member of the EuroFinUse Board of Directors, used this opportunity for numerous bilateral and multilateral talks. In this context this has been his fourth visit to Madrid, after participating there at the following past events: last year's international conference of the World Federation of Investors (WFI) and the conference of the International Financial Litigation Network (IFLN), AEMEC Congress and a meeting with the Santander Bank management team in 2011, and the General Assembly of the European Association of Shareholders (Euroshareholders) at the Chamber of Commerce and Industry in Madrid in 2010. After having finished his visit to Spain, the VZMD President is, with a stop in Brussels, immediately departing for Burkina Faso, where he will be attending West−Africa Business Forum Africallia 2014, which is taking place in the capital Ouagadougou.

After having finished his visit to Spain, the VZMD President is, with a stop in Brussels, immediately departing for Burkina Faso, where he will be attending West−Africa Business Forum Africallia 2014, which is taking place in the capital Ouagadougou.

Besides many esteemed guests from the field of economy, diplomacy and politics, the President of the Pan-Slovenian Shareholders' Association (

Besides many esteemed guests from the field of economy, diplomacy and politics, the President of the Pan-Slovenian Shareholders' Association (

Following the filling of three lawsuits by VZMD

Following the filling of three lawsuits by VZMD

In the framework of yesterday's Conference the assembled audience was initially addressed by: Belarussian Deputy Foreign Minister Elena Kupchina, General Director of the Directorate for Economic Diplomacy of the Republic of Slovenia Mr Stanislav Raščan, PhD, and Deputy Chairman of the Belarussian Chamber of Commerce Mr Vladimir Ulakhovich. A representative of the Slovenian Chamber of Commerce (

In the framework of yesterday's Conference the assembled audience was initially addressed by: Belarussian Deputy Foreign Minister Elena Kupchina, General Director of the Directorate for Economic Diplomacy of the Republic of Slovenia Mr Stanislav Raščan, PhD, and Deputy Chairman of the Belarussian Chamber of Commerce Mr Vladimir Ulakhovich. A representative of the Slovenian Chamber of Commerce ( The presentations were followed by B2B business meetings where a great interest was expressed in cooperation and the possibilities provided by the two VZMD business-investment programmes. Therefore Mr Verbič, M.Sc., had most meetings of all the 15 Slovene representatives – 8 meetings had been planned initially, however, due to the additional interest Mr Verbič held 11 meetings with the Belarussian participants at the Conference. The conversations were followed by meetings with the representatives of Belarussian institutions in the framework of mixed committee, and a dinner afterwards.

The presentations were followed by B2B business meetings where a great interest was expressed in cooperation and the possibilities provided by the two VZMD business-investment programmes. Therefore Mr Verbič, M.Sc., had most meetings of all the 15 Slovene representatives – 8 meetings had been planned initially, however, due to the additional interest Mr Verbič held 11 meetings with the Belarussian participants at the Conference. The conversations were followed by meetings with the representatives of Belarussian institutions in the framework of mixed committee, and a dinner afterwards. The Conference in Minsk was the last – the 18th carried out abroad this year (

The Conference in Minsk was the last – the 18th carried out abroad this year (

After the gala opening of the Forum on Tuesday and a panel the participants were discussing the themes of infrastructure, agriculture, energy, tourism and information technology and communications.

After the gala opening of the Forum on Tuesday and a panel the participants were discussing the themes of infrastructure, agriculture, energy, tourism and information technology and communications. Suitable provisions have also been made this time to ensure successful presentations of the companies, institutions and investment projects included in the two VZMD international business-investment programmes.

Suitable provisions have also been made this time to ensure successful presentations of the companies, institutions and investment projects included in the two VZMD international business-investment programmes. After the active participation at the business conference in the framework of theSlovene business delegation, and after participation at numerous events, meetings and

After the active participation at the business conference in the framework of theSlovene business delegation, and after participation at numerous events, meetings and  Before his departure from Canada VZMD President attended the central event of

Before his departure from Canada VZMD President attended the central event of During his visit to Canada Mr Verbič met numerous representatives and respected members of the Slovenian community, among others Honorary Consul General of the Republic of Slovenia in Canada Mr John Dom, Charge d'affaires ad interim at the Slovenian Embassy in Ottawa Ms Irena Grill, Executive Director of KREK Credit Union Ltd. Mr Joseph Cestnik, Top Grade Molds, Ltd. Executive Director Mr Joe Slobodnik, SKAL International ex-President Mr Frank Vismeg, the representative of Bank of Montreal Ms Sylvia Turk, Kearns Waste Sciences, Ltd. Representative Mr John Ivan Plut, Editor of the Canadian magazine »Glasilo«Ms Milena Soršak, J.M. Die Limited CEO Mr Joe Skof, the owner of a famous boat, anchored in Toronto, and former Jadran restaurant owner Mr John Letnik – Captain John (on the left of the photo), etc.

During his visit to Canada Mr Verbič met numerous representatives and respected members of the Slovenian community, among others Honorary Consul General of the Republic of Slovenia in Canada Mr John Dom, Charge d'affaires ad interim at the Slovenian Embassy in Ottawa Ms Irena Grill, Executive Director of KREK Credit Union Ltd. Mr Joseph Cestnik, Top Grade Molds, Ltd. Executive Director Mr Joe Slobodnik, SKAL International ex-President Mr Frank Vismeg, the representative of Bank of Montreal Ms Sylvia Turk, Kearns Waste Sciences, Ltd. Representative Mr John Ivan Plut, Editor of the Canadian magazine »Glasilo«Ms Milena Soršak, J.M. Die Limited CEO Mr Joe Skof, the owner of a famous boat, anchored in Toronto, and former Jadran restaurant owner Mr John Letnik – Captain John (on the left of the photo), etc. Immediately after returning to Europe VZMD President departed for Bucharest – via Istanbul where he was supposed to attend the postponed opening of the Turkish-Slovenian Business Club yesterday – and today he is to attend the Economic Forum at the Romanian Parliament, alongside the meeting of the Middle & Eastern European Prime Ministers with the Chinese Prime Minister, and on this occasion Mr. Verbič is also going to meet Slovenian Prime Minister Ms Alenka Bratušek, MA. This is his second visit to Bucharest this year, after the

Immediately after returning to Europe VZMD President departed for Bucharest – via Istanbul where he was supposed to attend the postponed opening of the Turkish-Slovenian Business Club yesterday – and today he is to attend the Economic Forum at the Romanian Parliament, alongside the meeting of the Middle & Eastern European Prime Ministers with the Chinese Prime Minister, and on this occasion Mr. Verbič is also going to meet Slovenian Prime Minister Ms Alenka Bratušek, MA. This is his second visit to Bucharest this year, after the  Mr. Kristjan Verbič, M.Sc., the President of VZMD (Pan-Slovenian Shareholders' Association) has been, as an active member of the Slovene business delegation, visiting Toronto since Wednesday, in the framework of the efforts of (

Mr. Kristjan Verbič, M.Sc., the President of VZMD (Pan-Slovenian Shareholders' Association) has been, as an active member of the Slovene business delegation, visiting Toronto since Wednesday, in the framework of the efforts of (