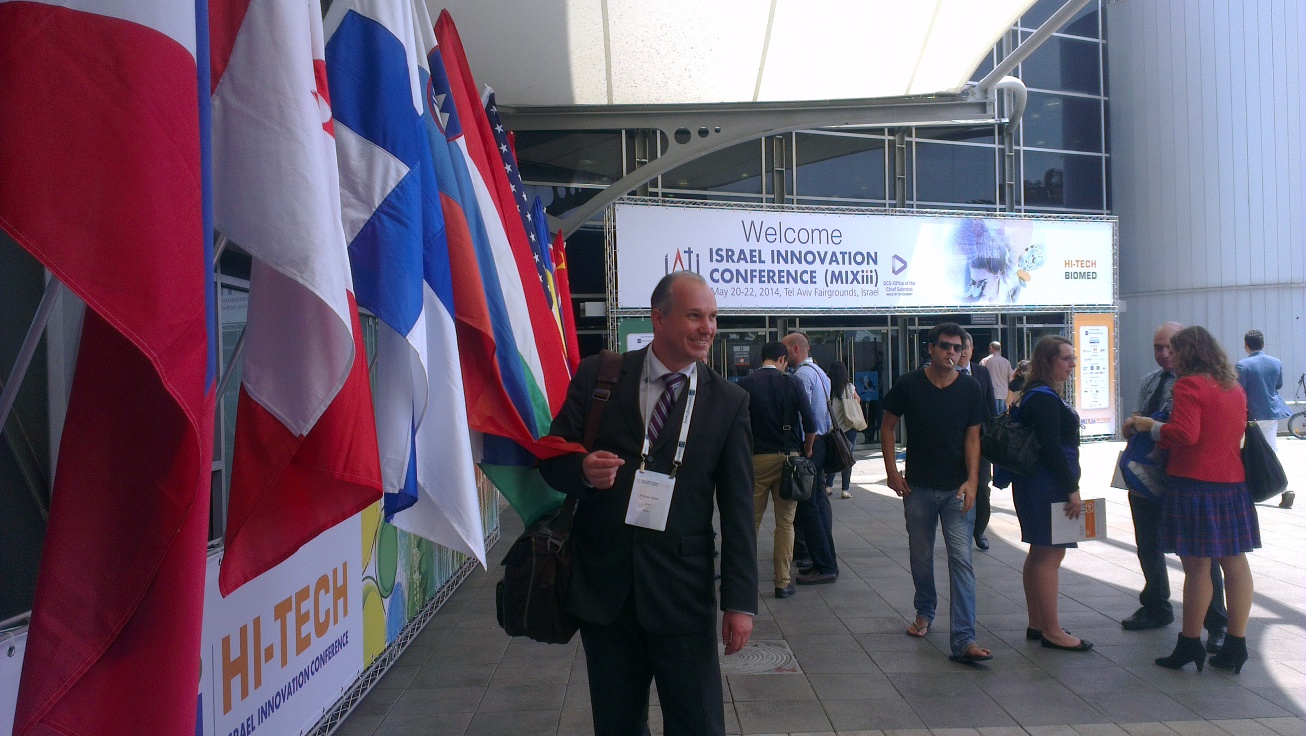

TEL AVIV – central international business-scientific conference »Israel Innovation Conference« along with the presentations of some leading scientists, innovators, company directors and global corporations and numerous B2B meetings – a great interest in V

A three-day international conference »Israel Innovation Conference (MIXiii)« started in Tel Aviv on Tuesday with a gala opening. The conference is a key business-scientific event in Israel, the country with most innovative or start-up companies per capita. It is also one of the biggest conferences of this type in global context with more than 7,000 attendees from all over the world. The assembled participants were in the introduction addressed by the Chinese Vice Premier Liu Yandong and Israeli President Shimon Peres, and both of them later exchanged a few words with the President of the Pan-Slovenian Shareholders' Association (VZMD) Kristjan Verbič, MSc.

A three-day international conference »Israel Innovation Conference (MIXiii)« started in Tel Aviv on Tuesday with a gala opening. The conference is a key business-scientific event in Israel, the country with most innovative or start-up companies per capita. It is also one of the biggest conferences of this type in global context with more than 7,000 attendees from all over the world. The assembled participants were in the introduction addressed by the Chinese Vice Premier Liu Yandong and Israeli President Shimon Peres, and both of them later exchanged a few words with the President of the Pan-Slovenian Shareholders' Association (VZMD) Kristjan Verbič, MSc.

The VZMD President attended the conference with numerous B2B meetings on the invitation of the Slovenian Embassy in Israel and Jožef Stefan Institute, and he attended the conference in the framework of this year's third tour of the VZMD international business-investment programmes: Invest to Slovenia (investo.si) and International Investors` Network (invest-to.net). In the framework of this tour Mr Verbič in the past 22 days prepared Slovenian business day in Denmark, he actively participated at the OECD Forum 2014 in Paris, joined the Slovenian business delegation visiting Teheran and Isfahan and he attended the annual conference of the International Financial Litigation Network (IFLN) in New York.

Participants at the business-scientific conference in Tel Aviv had the possibility to talk and exchange opinions with numerous esteemed experts and representatives of world corporations which have the leading role in the area of innovations, development and investments. Lectures, round-table discussions and receptions have been divided according to individual areas, mostly the areas of biomedicine and high-technology. In addition to this B2B meetings have also been organised for the conference participants, with the purpose to exchange opinions, give presentations, finance new ideas and start-up companies and to establish business contacts.

Participants at the business-scientific conference in Tel Aviv had the possibility to talk and exchange opinions with numerous esteemed experts and representatives of world corporations which have the leading role in the area of innovations, development and investments. Lectures, round-table discussions and receptions have been divided according to individual areas, mostly the areas of biomedicine and high-technology. In addition to this B2B meetings have also been organised for the conference participants, with the purpose to exchange opinions, give presentations, finance new ideas and start-up companies and to establish business contacts.

Besides the conference, the official visit of the Slovenian Minister of Education, Science and Sport Dr Jernej Pikalo took place as well, granting the awards to start-up companies. After the conference was concluded an evening reception, organised by the Slovenian Embassy in Israel, also took place.

After this year's successful presentations of companies, institutions and investment projects in Bled, Bratislava, Brussels, Copenhagen, Madrid, New York, New Delhi, Ouagadougou, Paris and Teheran and last year's in Astana, Almaty, Baku, Bled, Brussels, Buffalo,Bucharest, Cape Town, Celje, Dubai, Vienna, Kiev, Ljubljana,Madrid, Minsk, Moscow, New Delhi, Tokyo, Toronto and Zagreb, VZMD is planning to be actively present and to carry out the presentations on five continents this year!

After this year's successful presentations of companies, institutions and investment projects in Bled, Bratislava, Brussels, Copenhagen, Madrid, New York, New Delhi, Ouagadougou, Paris and Teheran and last year's in Astana, Almaty, Baku, Bled, Brussels, Buffalo,Bucharest, Cape Town, Celje, Dubai, Vienna, Kiev, Ljubljana,Madrid, Minsk, Moscow, New Delhi, Tokyo, Toronto and Zagreb, VZMD is planning to be actively present and to carry out the presentations on five continents this year!

VZMD kindly invites those wishing to participate in their events in activities to contact the VZMD investo.si programme coordinator by phone 031 770 771 or e-mail This email address is being protected from spambots. You need JavaScript enabled to view it." target="_blank">info@inves>to.si.

The second Iranian-Slovenian Business Conference with business B2B meetings among Slovenian and Iranian businessmen took place yesterday 460 km away in Isfahan at the Chamber of Commerce, Industries, Mines and Agriculture (ECCIMA). On this occasion the members of the Slovenian business delegation also backed a special

The second Iranian-Slovenian Business Conference with business B2B meetings among Slovenian and Iranian businessmen took place yesterday 460 km away in Isfahan at the Chamber of Commerce, Industries, Mines and Agriculture (ECCIMA). On this occasion the members of the Slovenian business delegation also backed a special  The VZMD President is otherwise visiting Iran in the framework of this year's third tour of investo.si and invest-to.net programmes. In the framework of the tour this time the VZMD President, apart from carrying out many duties in Eurovision Copenhagen, also paid a one-day-visit to the OECD Forum in Paris. Immediately after the activities in Iran are completed, he is to depart for New York to attend an annual conference at the invitation of the International Financial Litigation Network (

The VZMD President is otherwise visiting Iran in the framework of this year's third tour of investo.si and invest-to.net programmes. In the framework of the tour this time the VZMD President, apart from carrying out many duties in Eurovision Copenhagen, also paid a one-day-visit to the OECD Forum in Paris. Immediately after the activities in Iran are completed, he is to depart for New York to attend an annual conference at the invitation of the International Financial Litigation Network (

In the framework of the current Forum, Mr Verbič also attended a joint press conference with the Slovenian Prime Minister and OECD Secretary-General and he asked them both a question related to the Slovenian Prime Minister's speech in which she stated that in December last year the trust into the Slovenian financial and banking system had once again been restored. Mr Verbič emphasized the expropriation of more than 100.000 owners of shares and bonds in the Slovenian banks and pointed out that the above-mentioned move caused extreme outrage among foreign investors. The VZMD President also provided an example of the total loss of trust of the investors at the Warsaw stock exchange where Nova KBM shares were quoted until the radical expropriation measures took place.

In the framework of the current Forum, Mr Verbič also attended a joint press conference with the Slovenian Prime Minister and OECD Secretary-General and he asked them both a question related to the Slovenian Prime Minister's speech in which she stated that in December last year the trust into the Slovenian financial and banking system had once again been restored. Mr Verbič emphasized the expropriation of more than 100.000 owners of shares and bonds in the Slovenian banks and pointed out that the above-mentioned move caused extreme outrage among foreign investors. The VZMD President also provided an example of the total loss of trust of the investors at the Warsaw stock exchange where Nova KBM shares were quoted until the radical expropriation measures took place. Otherwise, the famous Forum is being attended by numerous important representatives of states, institutions and companies from all over the world, among them the Japanese Prime Minister Shinzo Abe, Turkish Minister of Economy Ali Babacan, Indonesian Finance Minister Muhamad Chatib Basri, Slovenian Foreign Minister Karel Erjavec and Slovenian Minister of Economic Development and Technology Metod Dragonja. Besides the Slovenian Prime Minister there are two more Slovenes speaking at the current forum: Drago Kos, President of the Slovene OECD Working Group on Bribery and Mateja Kožuh Novak, President of the Slovene Federation of Pensioners' Association. Thus, Mr Verbič yesterday met numerous Forum participants and the highest Slovenian and foreign representatives and again provided an adequate presentation of the VZMD international business-investment programmes: Invest to Slovenia (

Otherwise, the famous Forum is being attended by numerous important representatives of states, institutions and companies from all over the world, among them the Japanese Prime Minister Shinzo Abe, Turkish Minister of Economy Ali Babacan, Indonesian Finance Minister Muhamad Chatib Basri, Slovenian Foreign Minister Karel Erjavec and Slovenian Minister of Economic Development and Technology Metod Dragonja. Besides the Slovenian Prime Minister there are two more Slovenes speaking at the current forum: Drago Kos, President of the Slovene OECD Working Group on Bribery and Mateja Kožuh Novak, President of the Slovene Federation of Pensioners' Association. Thus, Mr Verbič yesterday met numerous Forum participants and the highest Slovenian and foreign representatives and again provided an adequate presentation of the VZMD international business-investment programmes: Invest to Slovenia (

the two-day journey of the band and team of the Slovenian representative travelling from Slovenia to Denmark by camper vans.

the two-day journey of the band and team of the Slovenian representative travelling from Slovenia to Denmark by camper vans.

Minister Erjavec, together with the representatives of the Slovenian Ministry for Agriculture and Environment and the Ministry of Infrastructure and Spatial Planning, listened attentively to the initiatives, plans and arguments, and he promised that the Foreign Ministry will provide support for the presented proposals.

Minister Erjavec, together with the representatives of the Slovenian Ministry for Agriculture and Environment and the Ministry of Infrastructure and Spatial Planning, listened attentively to the initiatives, plans and arguments, and he promised that the Foreign Ministry will provide support for the presented proposals. On Friday the members of the business delegation were attending the Slovenian−Slovakian business forum, which took place at the Ministry of Foreign Affairs of the Republic of Slovakia. Beside the Slovenian Foreign Minister, the assembled audience was in the introduction also addressed by the Secretary at the Slovakian Foreign Ministry, while the representatives of the Slovakian Investment and Trade Development Agency SARIO, the director of Datalab, Mr Andrej Mertelj, and Čedomir Bojanič, the director of the Slovenian Association of Port Logistics Providers, also presented Slovakian and Slovenian business environment in the field of information−communication technologies and logistics. The presentations were followed by two separate round−table discussions on the themes of logistics and information technology. The business forum ended with bilateral talks between Slovenian and Slovakian companies, and it was concluded by a mutual press conference of the Slovenian Foreign Minister Mr

On Friday the members of the business delegation were attending the Slovenian−Slovakian business forum, which took place at the Ministry of Foreign Affairs of the Republic of Slovakia. Beside the Slovenian Foreign Minister, the assembled audience was in the introduction also addressed by the Secretary at the Slovakian Foreign Ministry, while the representatives of the Slovakian Investment and Trade Development Agency SARIO, the director of Datalab, Mr Andrej Mertelj, and Čedomir Bojanič, the director of the Slovenian Association of Port Logistics Providers, also presented Slovakian and Slovenian business environment in the field of information−communication technologies and logistics. The presentations were followed by two separate round−table discussions on the themes of logistics and information technology. The business forum ended with bilateral talks between Slovenian and Slovakian companies, and it was concluded by a mutual press conference of the Slovenian Foreign Minister Mr  Otherwise Mr Verbič was attending the Bratislava conference in the framework of an intensive tour of the investo.si in invest-to.net programmes, and in the following days he will also be attending »

Otherwise Mr Verbič was attending the Bratislava conference in the framework of an intensive tour of the investo.si in invest-to.net programmes, and in the following days he will also be attending »

Burkina Faso is a member of the West African Economic and Monetary Union (UEMOA), which represents a common market for eight West African states which have more than 100 million inhabitants altogether. UEMOA, which comprises Benin, Burkina Faso, Ivory Coast, Guinea Bissau, Mali, Niger, Senegal and Togo, was established at the beginning of 1994, primarily with an aim to increase competitiveness through the common market, coordination of the member states' economic policies, and the supervision and harmonisation of the fiscal policies. These countries are considered to be very promising countries, and they have gained considerable attention from various foreign multinational corporations.

Burkina Faso is a member of the West African Economic and Monetary Union (UEMOA), which represents a common market for eight West African states which have more than 100 million inhabitants altogether. UEMOA, which comprises Benin, Burkina Faso, Ivory Coast, Guinea Bissau, Mali, Niger, Senegal and Togo, was established at the beginning of 1994, primarily with an aim to increase competitiveness through the common market, coordination of the member states' economic policies, and the supervision and harmonisation of the fiscal policies. These countries are considered to be very promising countries, and they have gained considerable attention from various foreign multinational corporations. After the successful collaboration at the

After the successful collaboration at the